Content

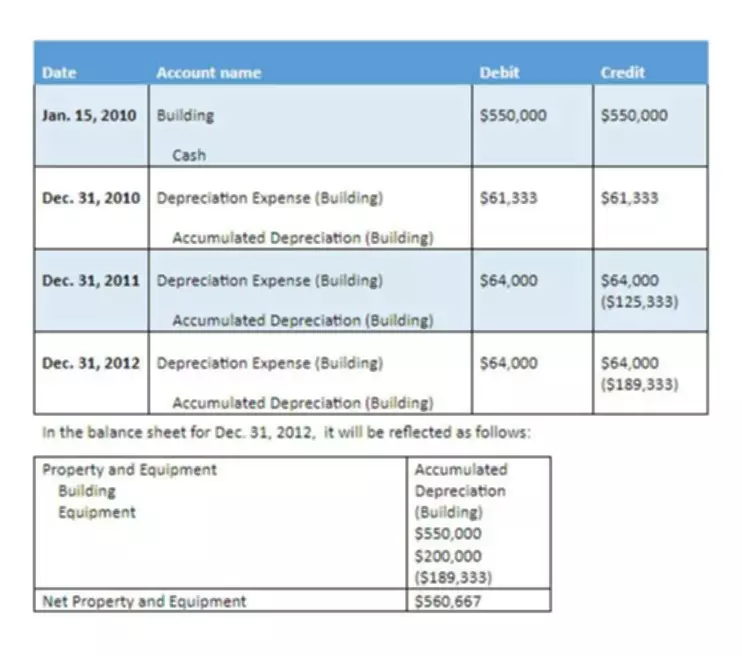

Its a ledger account that has the account title at the top, debits on the left, credits on the right while a middle line separates the two columns, resembling a large T drawn on the page. A T Account is the visual structure used in double entry bookkeeping to keep debits and credits separated. T-accounts can also impact balance sheet accounts such as assets as well as income statement accounts such as expenses. It works particularly well when recording debits and credits because it clearly shows the two sides of a transaction on either side of the horizontal line within the structure. This makes it easy to add up all transactions and balance books, which is one of the main purposes of a T-account. A T-account is a tool used in accounting to visually represent changes in individual account balances. Each t-account has two columns, one for debits and the other for credits.

‘Ending cash bail is going to make everyone safer’: Lake County state’s attorney discusses Illinois SAFE-T Act – Lake and McHenry County Scanner

‘Ending cash bail is going to make everyone safer’: Lake County state’s attorney discusses Illinois SAFE-T Act.

Posted: Fri, 14 Oct 2022 18:30:12 GMT [source]

These documents will allow for financial comparisons to previous years, help a company to better manage its expenses, and allow it to strategize for the future. Debits increase asset or expense accounts, while credits decrease them. That’s because we increased our rent expense for the amount of the rent. In turn, by paying the rent, we also decreased the amount of cash available in the bank. While we only completed one transaction , two accounts were affected. Here’s a visual illustration of how transactions would appear in the accounts that compose the balance sheet such as assets, liabilities, and equity. The figures on your company’s financial statements tell only a small part of the story even though they reflect the bigger picture.

Financial Accounting

In most businesses this journal is used to record non-cash transactions. However, postings on the left are not automatically considered increases, just as postings on the right are not automatically decreases. Every transaction involves at least one debit and one equal and offsetting credit. If there is more than one cash t account example debit or credit in a transaction the total of the debits and credits must be equal. Accounting ends with score keeping but begins with record keeping. The first task of accounting is to accurately record transactions. Transactions are events that change the composition of a firm’s assets, liabilities, and equity.

How is an increase in a liability account recorded in a T-account? An increase in a liability account represents a credit and should be posted on the right side of a T-account. The two accounts affected in this transaction are Utilities Expense account and Cash account.

Why Do Accountants Use T Accounts?

In the last column of the Cash ledger account is the running balance. This shows where the account stands after each transaction, as well as the final balance in the account. How do we know on which side, debit or credit, to input each of these balances? It is a good idea to familiarize yourself with the type of information companies report each year. Peruse Best Buy’s 2017 annual report to learn more about Best Buy. Take note of the company’s balance sheet on page 53 of the report and the income statement on page 54.

When you’re ready to use T-accounts, you can use them separately, in order to view journal entry details, or you can enter the transaction directly into your journal. T-accounts are called such because they are shaped like a T. How is a decrease in a revenue account recorded in a T-account? A decrease in a revenue account is a debit and should be recorded on the left side of a T-account. Additionally, it allows proper balancing of accounts because discrepancies will be avoided in the recording of each transaction. This gives companies an accurate picture of where they stand financially at any given time.

Understanding T-Account

Recall, that the T-Account is used to show the effects of a transaction. It tells us where if these accounts are going up https://quickbooks-payroll.org/ or down with a transaction. Before you can begin to use a T-account, you have to understand some basic accounting terms.